by Katrina Brown | May 26, 2020 | Leasing, Property Law, Uncategorized

You are a property owner with retail shop and you want to lease the shop. If you are in Queensland, you must comply with the Retail Shop Leases Act 1994 (QLD). To keep you on track, we provide links to the Queensland approved forms for use when you want to lease your Queensland retail shop.

Step 1: You must provide the proposed lessee with a “Lessor Disclosure Statement” at least 7 days before the lessee enters into the lease.

https://www.publications.qld.gov.au/dataset/retail-shop-leases-forms/resource/2c3c0a67-dd91-461f-9adf-211c365bd8c9

Step 2: You must provide the proposed lessee with a “Lessee Disclosure Statement”, which the lessee must complete and return to you before finalising the lease (although they can provide to you with the signed lease if you accept this deferral).

https://www.publications.qld.gov.au/dataset/retail-shop-leases-forms/resource/809e8911-a270-491f-9789-f89d8af0eab2

Step 3: You must provide the proposed lessee with a “Financial Advice Report”, which must be completed and returned to you. The Financial Advice Report must be completed by an accountant who acts for the proposed lessee.

https://www.publications.qld.gov.au/dataset/retail-shop-leases-forms/resource/a6ae0d8e-4292-4965-8b27-062700ccc492

Step 4: You must provide the proposed lessee with a “Legal Advice Report”, which must be completed and returned to you. The Legal Advice Report must be completed by a solicitor who acts for the proposed lessee.

https://www.publications.qld.gov.au/dataset/retail-shop-leases-forms/resource/f02df614-8146-4326-8fc9-f499ef692e41

Step 5: In any circumstance in which any amount other than rent is going to be charged by you to the proposed lessee, you must complete the Estimate of Outgoings and provide to the proposed lessee with the above documents. It is critical you make this disclosure as close to factual as possible, as substantial discrepancies provides the lessee with a defense to claims for outgoings.

https://www.publications.qld.gov.au/dataset/retail-shop-leases-forms/resource/6d7f02d7-0877-4c91-ae52-dc0550e70ce2

A retail lease is far more complex than a standard commercial lease. This is because the Queensland legislation requires you, as lessor, to disclose and receive disclosure on specific matters. A failure on your part to properly disclose or receive disclosure, notwithstanding the best written lease, exposes you to damages, which include potential voiding of the lease and refunding of charges raised.

Nautilus Law Group have seasoned property lawyers and conveyancers who can assist you with your retail leasing needs – from settling the original disclosure, to preparing the lease and amendment documents, to dealing with disputes. We offer fixed fee services for most property matters, and welcome you to make enquiry with our team by telephone to 07 5574 3560 or info@nautiluslaw.com.au.

by Katrina Brown | May 13, 2020 | Conveyancing, Property Law

Understanding cooling off is critical!

A recent matter has prompted us to write an article warning of the dangers of entering into a contract for the purchase of a property without being absolutely sure that you are ready to do so.

We recently received a call from a client who told us that they had signed an unconditional contract for the purchase of a property the previous day, but after a night of contemplation, the client had decided that the contract made them nervous, as they were waiting on their current property to sell. The client called to ask for our advice on whether they could terminate the contract.

We have found that although many clients are aware that the standard contract for residential purchases in Queensland (the Real Estate Institute of Queensland Contract) contains a statutory clause enabling them to terminate under a five-day cooling off period, they are not aware of the fact that a 0.25% termination penalty applies. On the face of it, 0.25% does not sound like much, but in this instance, when the purchase price was $900,000.00, the termination penalty was $2,250.00.

The client chose to terminate that same day and the seller issued the penalty as anticipated. The issue of the penalty was not changed by the fact that the property sold the following day to another purchaser. The fact that this scenario seems unfair does not change the rights of the seller to impose this penalty.

The worst part of this situation was that it would have been easy for the client to have inserted one special condition into their contract making the contract conditional upon the sale of their current property if they had first sought legal advice (in this instance, there would have been no penalty in the event of termination and the client could have purchased their ideal home without the stress encountered in our client’s situation).

If you need assistance in drafting special conditions into your Contract, please feel free to contact our office on 07 5574 3560.

https://www.qld.gov.au/law/housing-and-neighbours/buying-and-selling-a-property/buying-a-home/making-an-offer-on-a-home/contract-of-sale

by Tyler Smith | Apr 23, 2020 | Leasing, Property Law

On 7 April 2020, the Federal Government released the National Cabinet Mandatory Code of Conduct (the Code), which is applicable to certain commercial tenancies of small and medium enterprises which have been impacted by the COVID-19 pandemic (SME Tenancies).

The Code is to be introduced into law by each State and Territory by legislation or regulations and will apply from a date after 3 April 2020 (to be defined by each State or Territory in legislation or regulations) and continue to operate while the JobKeeper programme is operational, which is currently until 27 September 2020.

Application of the Code

The Code applies to all commercial tenants (including retail and industrial tenants) who:

- are suffering financial stress or hardship due to the COVID-19 pandemic and are eligible for the Federal Government’s JobKeeper programme; and

- have an annual turnover of $50,000,000 or less (the Turnover Threshold).

In regard to franchises, the Turnover Threshold will be applied at the franchisee level.

In regard to retail corporate groups, the Turnover Threshold will be applied at the group level, and not the individual retail outlet level.

Overarching Principals

The Code provides overarching principals which work to meet the objective for SME Tenants and their landlords to share, in a proportionate, measured manner, the financial risk and cashflow impact during the COVID-19 period, whilst seeking to balance the interests of SME Tenants and their landlords.

The overarching principles include:

- SME Tenants and landlords share a common interest to work together to ensure businesses can survive and facilitate the resumption of normal trading activities;

- SME Tenants and landlords will negotiate in good faith to agree on temporary leasing arrangements to achieve mutually satisfactory outcomes;

- SME Tenants and landlords will act in an open, honest and transparent manner, disclosing sufficient and accurate information to achieve outcomes consistent with the Code;

- agreements must take into account the impact of COVID-19 on the SME Tenant in regard to revenue, expenses and profitability, and be proportionate to the impact;

- SME Tenants and landlords must assist each other in their dealings with other related stakeholders, including governments, utility companies, and financers in order to achieve outcomes which are consistent with the Code;

- landlords must not seek to permanently mitigate their risk in relation to default in negotiating agreements; and

- each lease must be considered on a case-by-case basis, having regard to the hardship suffered by the SME Tenant.

Leasing Principles

The Code provides the following leasing principles which should be applied as soon as practicable on a case-by-case basis:

- landlords must not terminate leases due to non-payment of rent during the COVID-19 pandemic period (or reasonable subsequent recovery period);

- SME Tenants must remain committed to the terms of their lease, subject to any amendments to their rental agreement negotiated under the Code. Material failure to abide by substantive terms of their lease will forfeit any protections provided by the Code to a SME Tenant;

- landlords must offer SME Tenants proportionate reductions in rent payable in the form of waivers and deferrals of up to 100% of the amount ordinarily payable, on a case-by-case basis, based on the reduction in the SME Tenant’s trade during the COVID-19 pandemic period and a subsequent reasonable recovery period;

- rental waivers must constitute no less than 50% of the total reduction in rent payable under principle #3 above over the COVID-19 pandemic period and may be greater where failure to do so would compromise the SME Tenant’s capacity to fulfil their ongoing obligations under the lease agreement, having consideration to the landlord’s financial ability to provide such additional waivers. SME Tenants may waive the requirement for a 50% minimum waiver;

- payment of rental deferrals by an SME Tenant must be amortised over the balance of the lease term, commencing after the end of the pandemic period; however, should less than 24 months remain in the term after the end of the pandemic period, then a SME Tenant may pay the deferred rent over a period and for a period of no less than 24 months, unless otherwise agreed by the parties;

- any reduction in statutory charges (e.g. land tax, council rates) or insurance incurred by a landlord will be passed on to the SME Tenant in the appropriate proportion applicable under the terms of the lease;

- a landlord should seek to share any benefit it receives due to deferral of loan payments by its financer, with the SME Tenant in a proportionate manner;

- landlords should where appropriate seek to waive recovery of any other expense (or outgoing payable) by a SME Tenant, under lease terms, during the period the SME Tenant is not able to trade, and landlords may reduce services to the leased premises in such circumstances;

- if negotiated arrangements under this Code necessitate repayment, this should occur over an extended period in order to avoid placing an undue financial burden on the SME Tenant. No repayment should commence until the earlier of the COVID-19 pandemic ending (as defined by the Australian Government) or the existing lease expiring, and taking into account a reasonable subsequent recovery period;

- no fees, interest or other charges should be applied on waived or deferred rent;

- landlords must not draw on a SME Tenant’s security for the non-payment of rent (be this a cash bond, bank guarantee or personal guarantee) during the period of the COVID-19 pandemic and/or a reasonable subsequent recovery period;

- SME Tenants should be provided with an option to extend leases for an equivalent period of the rent waiver and/or deferral period;

- landlords will not increase rent (except for retail leases based on turnover rent) for the duration of the COVID-19 pandemic and a reasonable subsequent recovery period; and

- landlords may not apply any prohibition on levy any penalties if tenants reduce opening hours or cease to trade due to the COVID-19 pandemic.

Reaching an Agreement

SME Tenants and landlords should apply the above Overarching and Leasing Principles to negotiate rent relief packages. If the parties fail to reach an agreement, the Code refers to a binding mediation process which will be implemented by each State and Territory; however, in Queensland legislation has not yet been introduced as at the date of this article.

Example of the Code’s Application

A tenant, who has provided sufficient and accurate information to the landlord which demonstrates that the tenant’s usual turnover is less than $50,000,000, has experienced a 70% reduction in turnover since 1 April 2020, due to COVID-19. The tenant is therefore an SME tenant and the lease is subject to the Code.

Taking the Code into consideration, the SME tenant and the landlord agree to the following:

- 35% waiver of rent during the pandemic period;

- 35% deferred rent to be repaid, interest free, over the final 24 months of the lease term;

- 30% of rent will continue to be paid during the pandemic period; and

- the landlord will not terminate the lease due to non-payment of rent and will not call on a personal guarantee.

The agreement is in accordance with the Code as the total waivers and deferrals are proportionate to the reduction in turnover, the total waivers represent half of the reduction in turnover, and the landlord is complying with the moratorium against termination and calling on security during the pandemic period.

If you require assistance in either understanding the application of the Code to your circumstances, or negotiating your lease pursuant to the Code, please do not hesitate to contact Tyler Smith by email at tyler@nautiluslaw.com.au, or phone on 07 5574 3560. We will be happy to assist you!

Code of Conduct – https://www.pm.gov.au/sites/default/files/files/national-cabinet-mandatory-code-ofconduct-sme-commercial-leasing-principles.pdf

JobKeeper Payment FAQ – https://treasury.gov.au/sites/default/files/2020-04/JobKeeper_frequently_asked_questions_2.pdf

JobKeeper Legislation – https://www.legislation.gov.au/Details/F2020L00419

Author – Tyler Smith

by Katrina Brown | Feb 23, 2020 | Commercial Agreements, Commercial Law, Conveyancing, Leasing, Property Law

It comes as a surprise to clients when, on occasion, they find themselves either subject to, or trying to enforce, “informal agreements”. Informal agreements may come in the form of an exchange of discussions in respect to an arrangement, or a signed Lease Offer. It may be that the informal agreement is a sword for a client (for example, the client wants to push the arrangement in the absence of a written contract signed by the parties), or a shield for a client (for example, the client wants to avoid the arrangement because there was no written contract signed by the parties – or the terms were not finally agreed).

Whether the arrangement relates to a supply of goods, services or a commercial leasing arrangement – a legally binding arrangement may be determined by way the conduct of the parties (such as one of the parties completing a condition agreed to start the arrangement (for example, supplying a service), or an exchange of emails about an arrangement), even in the absence of a formal contract – whether or not the contract is ultimately signed.

When are negotiations binding?

Courts look at the objective intention of the parties when determining whether there is a legally binding agreement. That is, whether a reasonable person would consider the agreement to be legally binding, and not the parties’ subjective intention.

Courts have found a legally binding agreement in the following situations:-

- When a vendor and purchaser of commercial property agreed to the essential terms of the agreement over email, noting that the agreement was “subject to contract” and “subject to execution”. A court found that this was essentially an “agreement to contract” and made judgement against the vendor (who attempted to withdraw from the transaction due having found a more favourable third party purchaser);

- Negotiations between a tenant and landlord whereby the essential terms of the lease were agreed upon were found to constitute an agreement to lease. This was the case even though the negotiations began with “subject to formal lease documents being signed” and that not all (minor) terms were agreed. The landlord was ordered to pay damages to the tenant for failing to countersign the formal lease document; and

- A tenant who, after negotiating and signing a letter of offer with a landlord, proceeded to obtain council approvals (with the landlord’s assistance) and took steps to fit-out premises without a formal lease in place was found to be bound by an agreement to lease.

When determining the intention of the parties, regard will be to the surrounding circumstances of the negotiations, the relationship of the parties, subject matter of the agreement and other relevant factors.

What can you do to ensure no binding agreement is in place until documents are signed?

Parties who do not wish to be bound by negotiations or pre-contract documents (e.g. heads of agreement) must ensure that they clearly and consistently reiterate to the other party in all correspondence that no legally binding agreement will be formed until formal and final documentation has been signed. As the above cases reveal, merely stating “subject to contract” is not enough.

Further, prospective tenants should not enter into possession and pay rent until the lease is signed as this may constitute acceptance by conduct. Conversely, a landlord should not accept rent until they are in a position to be bound. More generally, parties should not begin performing their obligations under the agreement before the documents are signed.

However, the risks of making an agreement conditional is as a sword which can be used against you – as the other party to a transaction may similarly withdraw from the arrangement if there is no legally binding agreement. This may mean that you could lose a commercially advantageous deal if it is not locked in.

In any negotiation, you should always seek legal advice before accepting the terms of an agreement (whether by email, orally or otherwise) and before signing any preliminary document.

Nautilus Law Group has a team of professionals experienced in commercial and property agreements. It may be that our team can give you a “thumbs up” or recommendation for variations in a short meeting, or for more complex matters – the engagement may be extended.

Engaging a lawyer to advise on an agreement is an investment in certainty, as the costs of remedying a failed arrangement greatly outweigh the costs savings of avoiding advice.

We welcome you to contact our Property and Commercial Team to discuss your arrangements. Please free to contact Vicki by clicking her name, or by phoning to arrange an appointment with Vicki on (07) 5574 3560.

by Katrina Brown | Jun 11, 2019 | Commercial Law, Conveyancing, Credit Management, Credit Management Advice, Property Law, SMSF, Tax Advisory

The release of PCG 2016/5 comes as no surprise, which follows on the back of the Australian Taxation Office (ATO) publications ATO ID 2015/27 and ATO ID 2015/28, which set the tone for related party Limited Recourse Borrowing Arrangements (LRBAs). The ATO’s 2015 position clarified that nil interest rates and/or interest rate terms being other than “commercial” in nature, constituted “non-arms’ length income” within the meaning of subsection 295.550(1) of the Income Tax Assessment Act 1997 (ITAA97).

PCG 2016/5 sails past interest rates, and now gives the ATO’s position on the entirety of related party LRBAs, including requirements for principal and interest monthly payments, security, terms of lending and standards for setting fixed and variable interest rates.

IS ANYONE REALLY SURPRISED BY PCG 2016/5?

Given the overriding “sole purpose test” at section 62 of the Superannuation Industry (Supervision) Act 1993 (SISA) – what would lead anyone to think a related party LRBA could be made on other than an “arms’ length” basis, with a commercial standard of reference required? Let’s think this through – we are limited in acquiring assets from members and “related parties” of members by section 66 of the SISA, we are prohibited from providing financial assistance to members and relatives of members by section 65 of the SISA and we are required to deal with investments at an “arms’ length” in accordance with section 109 of the SISA. So, does it come as any real surprise that, if a member or a related party of the member is going to lend money to the self-managed superannuation fund (SMSF), it has to be on commercial terms?

It scares me when Trustees lose sight of the overriding black cloud of Part IVA of the ITAA97, and forget that the ATO has the benefit of hindsight in assessing anti-avoidance schemes. Looking beyond Trustees, those of us advising Trustees must also be alert to our civil, and possible criminal, exposure under SISA, including but not limited to section 55 of the SISA, which puts us, as advisors, on the line to pay losses or damages suffered by any “person” (not limited to members) as a consequence of another “person” (not limited to trustees) involved in a contravention of a SISA covenant. Remembering the Courts and Financial Ombudsman Service quite often favour the consumer, we need only look to section 52 of the SISA to appreciate the broad liability stacked on our shoulders when giving advice to SMSF Trustees of any nature which is other than, on its face, based on all parties acting on commercial arms’ length terms.

Let’s look, therefore, at PCG 2016/5. Whilst the ATO provides us with peace of mind as to its interpretation of “arms’ length terms” for purposes of related party LRBAs in the Safe Harbour provisions, the ATO recognises at paragraph 4 of PCG 2016/5 that other arrangements may nonetheless be based on arms’ length terms.

Safe Harbour 1: The LRBA and real property (commercial or residential)

| Interest Rate |

Reserve Bank of Australia Indicator Lending Rates for banks providing standard variable housing loans for investors. Applicable rates:

– For the 2015-16 year, the rate is 5.75%[1]

– For the 2016 17 and later years, the rate published for May (the rate for the month of May immediately prior to the start of the relevant financial year) |

| Fixed / variable |

Interest rate may be variable or fixed

– Variable – uses the applicable rate (as set out above) for each year of the LBRA

– Fixed – trustees may choose to fix the rate at the commencement of the arrangement for a specified period, up to a maximum of 5 years.

The fixed rate is the rate published for May (the rate for the May before the relevant financial year).

The 2015-16 rate of 5.75% may be used for LRBAs in existence on publication of these guidelines, if the total period for which the interest rate is fixed does not exceed 5 years (see ‘Term of the loan’ below) |

| Term of the loan |

Variable interest rate loan (original) – 15 year maximum loan term (for both residential and commercial)

Variable interest rate loan (re-financing) – maximum loan term is 15 years less the duration(s) of any previous loan(s) relating to the asset (for both residential and commercial)

Fixed interest rate loan – a new LRBA commencing after publication of these guidelines may involve a loan with a fixed interest rate set at the beginning of the arrangement. The rate may be fixed for a maximum period of 5 years and must convert to a variable interest rate loan at the end of the nominated period. The total loan term cannot exceed 15 years.

For an LRBA in existence on publication of these guidelines, the trustees may adopt the rate of 5.75% as their fixed rate, provided that the total fixed-rate period does not exceed 5 years. The interest rate must convert to a variable interest rate loan at the end of the nominated period. The total loan cannot exceed 15 years. |

| Loan to Market Value Ratio (LVR) |

Maximum 70% LVR for both commercial and residential property

If more than one loan is taken out to acquire (or refinance) the asset, the total amount of all those loans must not exceed 70% LVR.

The market value of the asset is to be established when the loan (original or re-financing) is entered into.

For an LRBA in existence on publication of these guidelines, the trustees may use the market value of the asset at 1 July 2015. |

| Security |

A registered mortgage over the property is required |

| Personal guarantee |

Not required |

| Nature and frequency of repayments |

Each repayment is of both principal and interest

Repayments are monthly |

| Loan agreement |

A written and executed loan agreement is required |

Safe Harbour 2: The LRBA and a collection of stock exchange listed shares or units

| Interest Rate |

Reserve Bank of Australia Indicator Lending Rates for banks providing standard variable housing loans for investors plus 2%. Applicable rates:

– For the 2015-16 year, the interest rate is 5.75% + 2% = 7.75%[2]

– For the 2016-17 and later years, the rate published for May plus 2% (the rate for the May before the relevant financial year) |

| Fixed / variable |

Interest rate may be variable or fixed – Variable – uses the applicable rate (as set out above) for each year of the LBRA

– Fixed – trustees may choose to fix the rate at the commencement of the arrangement for a specified period, up to a maximum of 3 years (see ‘Term of the loan’ below). The fixed rate is the rate for May plus 2% (the rate for the May before the relevant financial year)

The 2015-16 rate of 7.75% may be used for LRBAs in existence on publication of these guidelines, if the total period for which the interest rate is fixed does not exceed 3 years (see ‘Term of the loan’ below) |

| Term of the loan |

Variable interest rate loan (original) – 7 year maximum loan term

Variable interest rate loan (re-financing) – maximum loan term is 7 years less the duration(s) of any previous loan(s) relating to the collection of assets

Fixed interest rate loan – a new LRBA commencing after publication of these guidelines may involve a loan that has a fixed interest rate set at the beginning of the arrangement. The rate may be fixed up to for a maximum of 3 years, and must convert to a variable interest rate loan at the end of the nominated period. The total loan term cannot exceed 7 years.

For an LRBA in existence on publication of these guidelines, the trustees may adopt the rate of 7.75% as their fixed rate, provided that the total period of the fixed rate does not exceed 3 years. The interest rate must convert to a variable interest rate loan at the end of the nominated period. The total loan cannot exceed 7 years. |

| LVR |

Maximum 50% LVR

If more than one loan is taken out to acquire (or refinance) the collection of assets, the total amount of all those loans must not exceed 50% LVR.

The market value of the collection of assets is to be established when the loan (original or re-financing) is entered into.

For an LRBA in existence on publication of these guidelines, the trustees may use the market value of the asset at 1 July 2015. |

| Security |

A registered charge/mortgage or similar security (that provides security for loans for such assets) |

| Personal guarantee |

Not required |

| Nature and frequency of repayments |

Each repayment is of both principal and interest

Repayments are monthly |

| Loan agreement |

A written and executed loan agreement is required |

So, what happens if you can’t fit your arrangements into the Safe Harbours? You aren’t sunk just yet.

LET’S CONSIDER THE LOAN TERMS…

If your client borrowed from a commercial lender to on-lend to the SMSF, what does the commercial lender’s terms to the client look like?

To keep this simple, let’s create a reference:

Client Pty Ltd, as Trustee for Client Superfund, borrows from John Smith, the sole director of Client Pty Ltd and sole member of Client Superfund, to acquire Greenacre for $500,000. John borrowed $530,000 from Awesome Bank, secured against his home, on a 30 year interest free term, with the first 5 years being interest free only, with principal and interest from year 6. John gave a personal guarantee, and also offered up security against his personal share portfolio. The LVR was 80% of the combined value of John’s home and his share portfolio. The interest on the loan is variable, based on Awesome Bank’s published rates. Awesome Bank has their own internal assessment processes for determining variable rates. John’s advisor told him that he could on-lend at the Awesome Bank’s rate for the full acquisition value, on matching loan terms. John’s advisor also made sure John registered a mortgage over the property. What happens now?

Can John rely on Awesome Bank’s terms to escape the Safe Harbours? Not entirely.

Awesome Bank has recourse against John’s income as well, as the security and later acquired assets of John (through the personal guarantee). John only has recourse against the real property owned by the SMSF, and nothing else. Accordingly, given the additional risk, one would expect a commercial lender in John’s position would have either required higher interest rates, shorter terms or a varied LVR. However, the terms of Awesome Bank’s lending to John are nonetheless material; the first approach for John is to seek out Awesome Bank’s LRBA terms. If Awesome Bank’s LRBA terms at the time of acquisition were more lenient than the Safe Harbour provisions, John has a commercial “arms’ length” reference to hold to support a variation from the Safe Harbour. However, to the extent his LRBA terms are more favourable than the Awesome Bank’s LRBA terms, John would need to vary his own LRBA to match (even if the variation was less than the Safe Harbour provisions).

What if Awesome Bank did not offer LRBA lending at the time of acquisition? Perhaps John could then look to Community Bank instead. If Community Bank has lending terms which were more lenient than the Safe Harbour provisions, then John would have a commercial “arms’ length” reference to support a variation.

To the extent John tries to find “arms’ length” terms different to the Safe Harbour provisions, he is best to ensure the comparative is truly “commercial”. John should not look to his best mate Bob, who is a third party lender, to provide the “commercial” comparative – unless Bob is a recognised credit provider who has engaged in LRBA arrangements as a regular component of his business (which business commenced well before the publication of ATO ID 2015/27 and ATO ID 2015/28).

LET’S CONSIDER SOME STRATEGIES…

Let’s say that John has to figure out how to raise the shortfall in the LVR. What are some options?

- John could make additional concessional and non-concessional contributions (subject to the contribution caps and restrictions) by allowing part of the loan to be paid down (do not forget the paperwork and required transactions!);

- John could invite new members to the fund and their rollovers and/or contributions could be used to reduce the loan (make sure the investment strategy is considered for each);

- John could sell the asset (which could be difficult by 30 June – but it is an option); and/or

- John could re-finance through Awesome Bank, and give Awesome Bank a personal guarantee (hopefully Awesome Bank values his business).

What if John is in pension phase, and he has to fund increased repayments on the LRBA from the SMSF? John could look to any of the above options, and he could also:

- Commute his pension and roll back to growth phase;

- Commute his pension, and commence a part pension with the balance of his member interest in growth phase; and/or

- Vary the terms of his pension to reduce his payments to the statutory minimums.

PCG 2016/5 is not the end of the world, but it is a wake-up call to all advisors in the SMSF space to favour conservatism in strategies. There may be litigation which flows out of PCG 2016/5, given some advisors made exceedingly ambitious strategic recommendations to clients who will not be able to float adequate remedial action by 30 June 2016. The ATO has given advisors a bit of leeway and, with a bit of creative manoeuvring, many SMSFs can sail to the Safe Harbours with minimal frustration (consider the above options, if the client could fund to lend – the client may likely remediate by treating funds as contributions).

If you would like to discuss PCG 2016/5 or what the ATO Safe Harbours mean for you or your clients, please contact Katrina Brown on 07 5574 3560 or via email.

Next Article: Can an Employee acquire a residential property as an investment in the Employee’s Self Managed Super Fund (“SMSF”), if the Employer is a Property Developer?

Previous Article: A complying self-managed superannuation fund may be settled by an instrument having the effect of a deed – allowing for execution by digital signature

by Katrina Brown | May 26, 2016 | Conveyancing, Powers of Attorney and Estate Planning, Property Law, Succession Law

If you hold real property with another person, it is important to know whether you hold the property as joint tenants or as tenants in common.

What’s the difference?

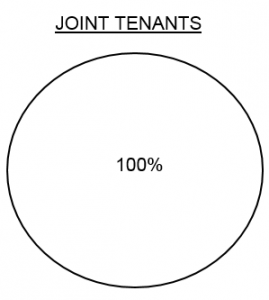

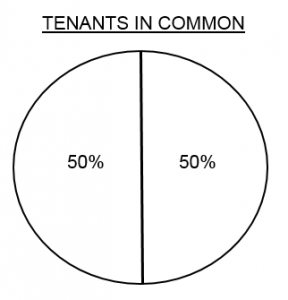

A joint tenancy is where two (or more) people (or legal entities) own an asset jointly – that is 100% of the asset is held in ALL names. No one owner has a fixed interest in the asset. This is commonly the situation between spouses. When one owner of the asset dies, their death is recorded and the asset automatically transfers into the name of the surviving owner. A “jointly held” asset does not (except in some instances in New South Wales) pass to your estate – it passes to the survivor automatically.

Conversely, a tenancy in common is where two (or more) people (or legal entities) own an asset, but each person owns a specified share. This situation is common in business dealings and in dealings where parties wish to own distinct interests in an asset. The below diagram shows a “tenancy in common” between a husband and wife, with the husband owning 50% of the asset, and the wife owning 50% of the asset. On the death of one of the spouses, their share passes to their estate and is distributed in accordance with their Will. The share does not pass automatically to the surviving spouse.

There are benefits and downsides to each type of holding; accordingly, owners need to be aware of the consequences of each option – to ensure suitability.

What happens if I want to change the way the asset is held?

If you hold an asset as joint tenants, and wish to sever the tenancy, or if you hold the property as tenants in common in equal shares and want to become joint tenants, it is possible to change the way the property is held. These transactions are commonly effected for estate planning or family law purposes.

This change is effected by way of a form signed by one or both property owners, which is then stamped and registered with the Titles Registry as a change of tenure transaction. In some circumstances, there is a transfer duty exemption which can apply.

If you wish to discuss changing the tenure on your property, please contact our office on 07 5574 3560.